Short Sale Success Story

October 19, 2015 01:00

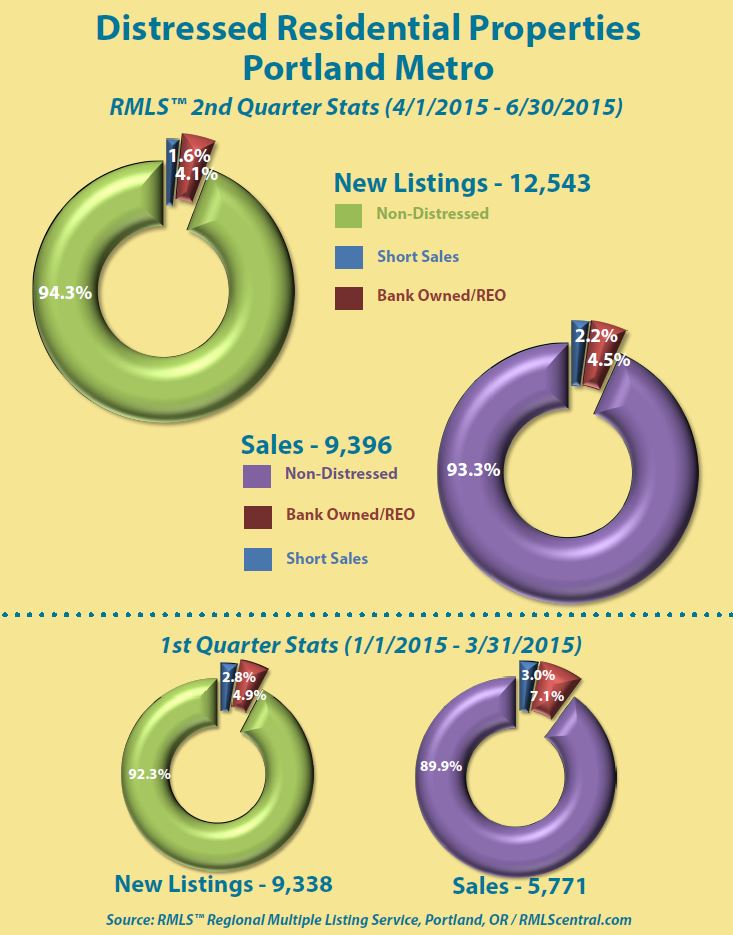

Short sales in Portland have ground to a halt. Of the new listings in the 2nd quarter of 2015, only 1.6% of the properties in the Portland Metro Area were short sales. In the 1st quarter of 2015, 2.8% of the new listings were short sales. This is a huge difference from just a few years ago. Hopefully we won't be seeing the huge wave of short sales that we saw in the great recession, but here is a story about a short sale listing that I closed a few years ago.

My client purchased a condo during the boom and found herself upside down because of the bust. Instead of hanging on to a severely upside down property, she chose to list and sell the Portland Condo as a short sale.

We chose the "step down" approach for price so that the 2 banks involved would have fewer objections. The "step down" approach is basically putting the property on the market at the amount that is owed, then reducing the price of the property systematically until a reasonable offer is reached.

We listed the property in Feb of 2012 and the seller accepted an offer in June of 2012; then we started the long arduous process of getting the two banks to accept the short sale. The bank that was in 1st position was gave us an acceptable response with about 2 months, but the bank that was in 2nd position Citibank was very slow to respond. It took about 4 months for Citibank to respond with the terms of acceptance.

Getting this transaction closed was a group effort. The seller was great. She provided the needed documents in a timely manner. The buyer was very patient and stuck it out to the closing date. The buyer's agent was on top of her game. The short sale negotiator was awesome too. The title company was able to pull all of the details together and get the transaction closed.

From the time of acceptance to closing the whole process took about 6 months, and this is considerably longer than my average short sale this year, but the bank in 2nd position was very difficult to work with, and they were very slow to respond.

One unique thing that we did in this transaction was to allow the buyers to become renters on a temporary basis. The property was tenant occupied when the condo was listed. The seller had moved out of town, and in order to cover part of her mortgage payment, she had rented out the condo. About 2 months ago, the tenant moved out, and the property was vacant.

The buyer really wanted to move in, the seller really did not want to lose any rental income, so the buyer was allowed to move into the property prior to closing as a tenant. This put the buyers at ease because they knew that the seller was committed to them, and they could start enjoying the property right away. In most cases, I would not suggest allowing buyers to move into a property before closing, but this was a special case where it made sense. I am happy to report that it did work out for all parties.

A lot of short sales fail because one of the parties to the transaction becomes impatient. Short sales are a challenge. They are much harder to close than traditional sales, but in some instances, they can be a win/win for the buyer and the seller. However, everybody needs to be on the same page. There needs to be clear communication between the listing agent and buyer's agent. The title company and/or short sale negotiator need to be in the loop. The buyer and seller need to understand that these things take time. But when everybody understands the details of a short sale, the deal gets done... booyah!